Allocate money to a spending account during enrollment

Does your employer offer a Lifestyle Spending Account (LSA), Health Spending Account (HSA), or a custom spending account (a spending account that’s unique to your employer)? If so, your employer will either:

Choose exactly how much money they allocate towards a spending account. For example, they might decide to give every employee $1,000 in an LSA.

Let you choose how you allocate your flexible dollars (money your employer gives you to pay for your benefits) to a spending account, but set rules around what percentage of flexible dollars you can allocate to each spending account. For example, they might decide you can only allocate a maximum of 50% of your flexible dollars to an HSA.

Give you complete freedom over how you choose to allocate your flexible dollars to a spending account in the “Wellness Accounts” section of the enrollment experience.

Tip: Not sure what spending account to allocate your money to? You can use the money in an LSA to pay for a variety of lifestyle and wellness products and services, but this money is considered taxable. You can use the money in an HSA to pay for eligible health and medical expenses, and this money isn’t taxed (except in Quebec). Learn more about LSAs and HSAs.

If your employer lets you choose how you allocate your flexible dollars, follow these steps to learn how to allocate money to a spending account in the enrollment experience.

To allocate money to a spending account:

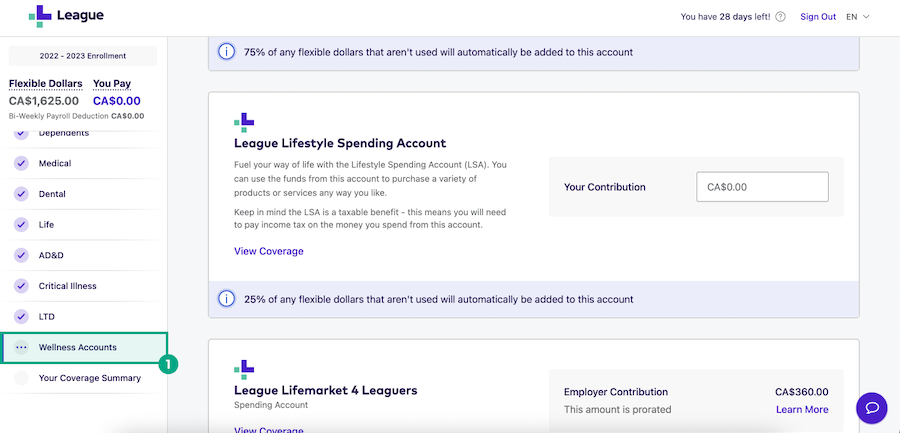

1. Navigate through the enrollment experience and select your benefits until you get to the “Wellness Accounts” section.

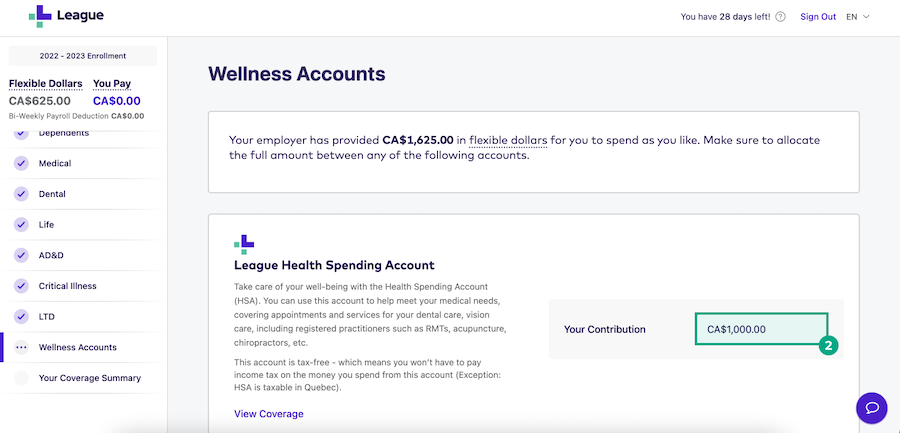

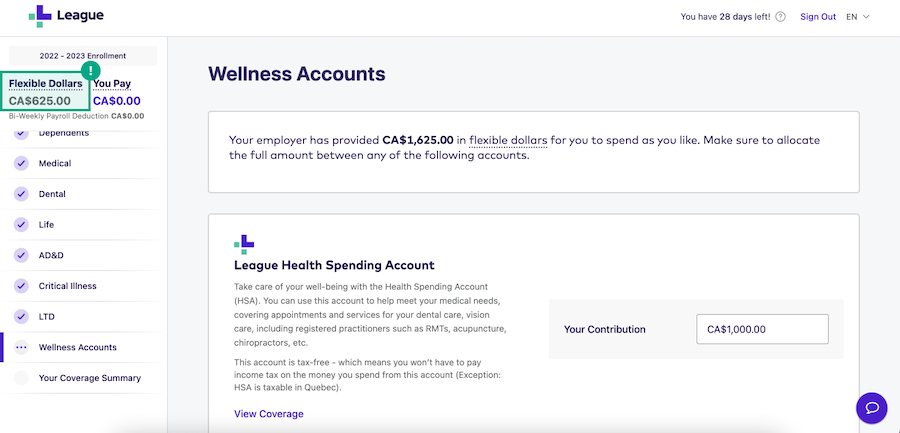

2. Enter a number in the “Your Contribution” text box, next to the spending account you want to allocate money towards. If your employer:

Set rules around what percentage of flexible dollars you can allocate to each spending account: You’ll see these rules listed under the “Your Contribution” text box.

Offers multiple spending accounts and gives you complete freedom over how you choose to allocate your flexible dollars: You could split the money equally between each spending account, allocate all the money to one spending account, or split the money in another way. Whatever works best for you and your needs!

Tip: You can see how many flexible dollars you have left to allocate at the top of the enrollment experience.

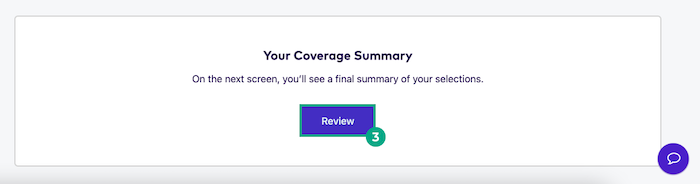

3. When you’re done, click “Review” and review your flexible dollar allocation.

Still have questions about allocating money to a spending account? Chat with us or email help@league.com.

.png)