What is a Health Spending Account (HSA)?

Note: This article is about Health Spending Accounts (HSAs) that are administered by League. If you have an HSA through an insurance carrier, it might be a bit different. Learn more in your Wallet.

A Health Spending Account (HSA) is a wellness account you can use to pay for eligible health and medical expenses. Continue reading to learn all about how an HSA works.

What you need to know

The Canada Revenue Agency (CRA) regulates what expenses are covered

Money you spend from this account isn’t taxed (except in Quebec)

Your dependents can use the money too!

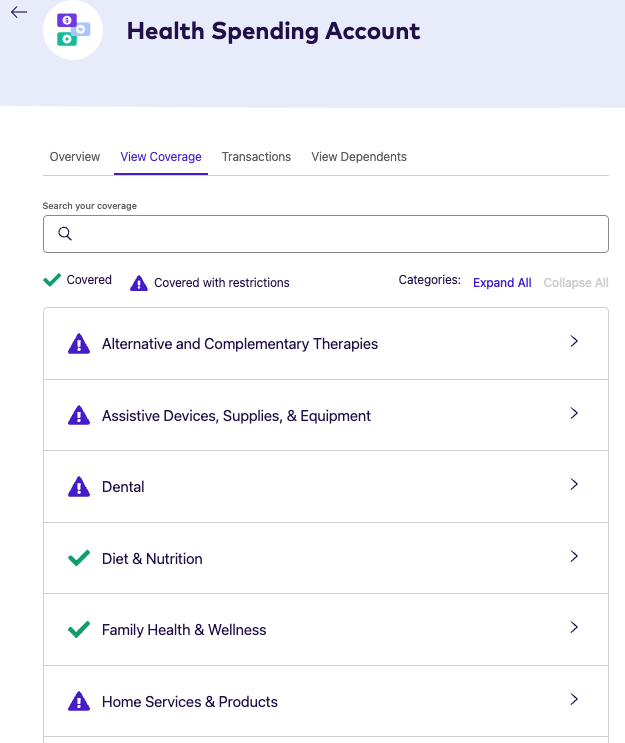

Find out what’s covered

HSAs cover a variety of health and medical products and services. Some examples of categories that are covered:

Mental Health & Wellness (like appointments with a registered therapist)

Paramedical Services (like appointments with a Registered Massage Therapist)

Vision (like prescription glasses)

The CRA decides what is covered by an HSA. Expenses must be considered medically necessary by the CRA. This is why you usually need to provide a prescription for an expense or visit a registered practitioner.

Learn what’s covered by your HSA.

It’s different than a Lifestyle Spending Account (LSA)

There are two main differences between an HSA and a LSA:

Money in an HSA can only be used for expenses that are considered medically necessary by the CRA, while a LSA can be spent on a variety of wellness products and services.

Money spent from an HSA isn’t taxed (with the exception of Quebec), while money spent from a LSA is considered taxable.

Understand how you’ll be taxed

HSAs are tax-free. You won’t be charged income tax on money you spend from this account. There’s one exception: HSAs are a taxable benefit in Quebec.

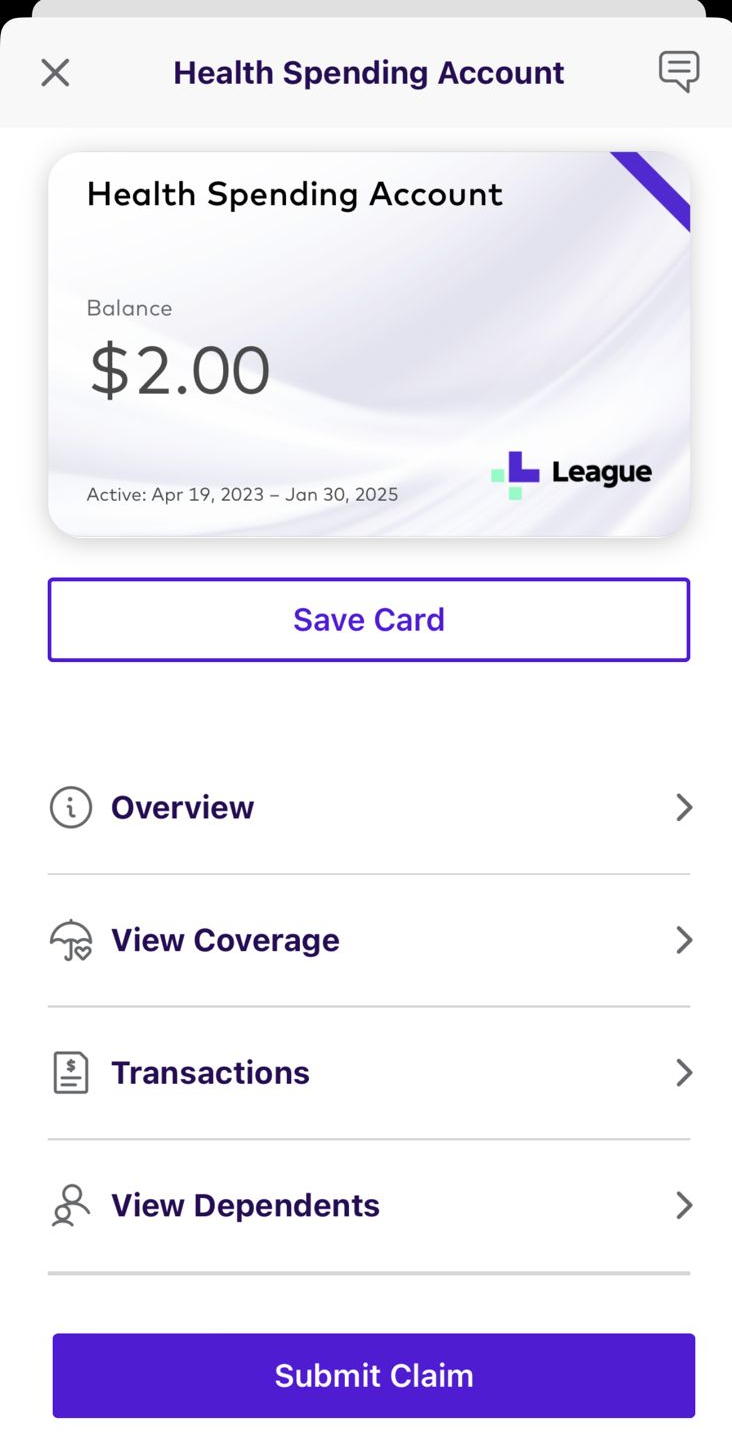

Submit claims

To spend the money in your HSA, make a purchase and submit a picture of the receipt and any other required information in your League Wallet.

Some things to remember:

HSAs can only be used to reimburse money you’ve already spent.

Before submitting a claim to your HSA, check if the expense is also covered by your benefits plan. If it is, you should always submit the claim to your carrier first!

Claims must be for eligible expenses that you paid for after your benefits became active (if you’re a new hire) or during your current plan year (if you’re an existing employee). For example, if your new plan year started in 2020 and you got new money in your HSA, you can’t use this new money to cover 2019 expenses.

Claims are approved based on the service date, not the purchase date. For example, if you book and pay for an RMT appointment before your benefits start but the appointment takes place after your benefits start, we can’t reimburse the expense.

Coordinate your benefits

If an expense is covered by both your benefits plan and your HSA, it should always be submitted to your benefits plan for reimbursement first. If your benefits plan doesn’t cover the full amount, you can then submit the remaining balance to your HSA. This is known as Coordination of Benefits (COB).

Tip: Learn more about COB.

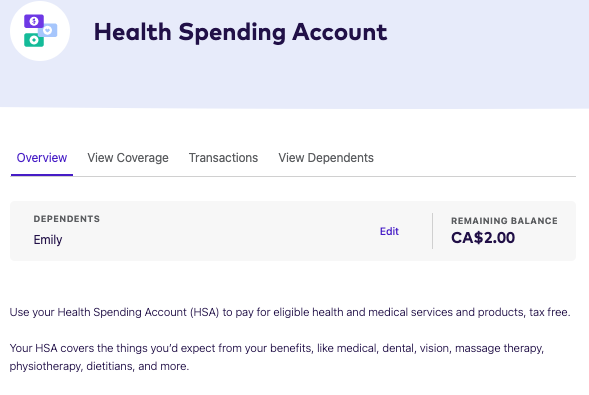

Spend on your dependents

The money in your HSA can also be spent on your dependents. The balance in your HSA is the total amount available for you and all your dependents (not the amount available for each person). Before you submit a claim for a dependent's expense, make sure you add them as a dependent in your League account.

.png)