Compare your current benefits selections to your new selections in the enrollment experience

We've provided all the information you need to make an informed decision within the annual enrollment experience. As you make your benefit selections, you can compare them to your current coverage.

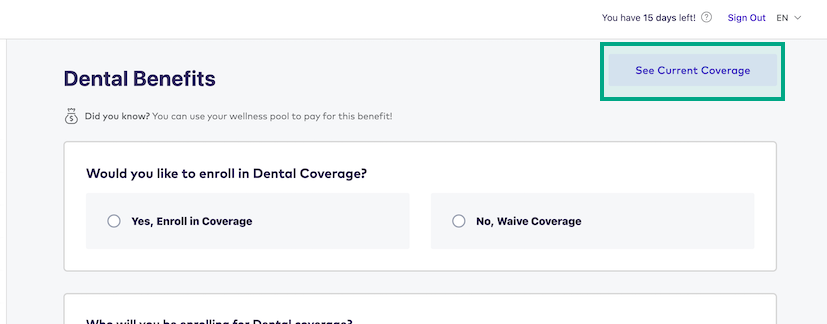

Click “See Current Coverage” at any point in the enrollment experience to compare your current and new benefit selections.

A pop-up will appear that shows details on your current:

Coverage (such as Medical or Dental)

Insurance (such as Life or Accident)

Wellness Account contributions

Coverage cost

Benefit Comparison Overview

This section will provide more details on what information you can view about your current coverage when you expand each benefit.

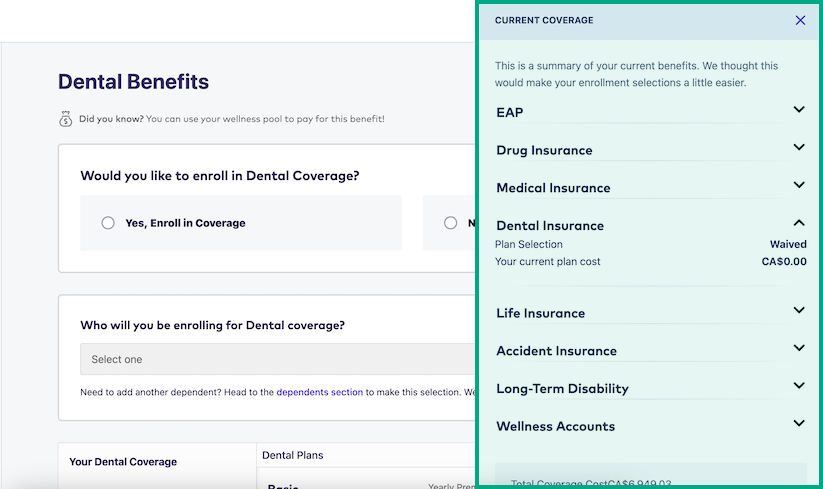

Coverage

Plan selection: The plan level you’re currently enrolled in. If you didn’t enroll in a benefit, this will say “Waived”.

Who’s covered: The people covered by your plan selection. This could be just you, or you and your dependents.

Your current plan cost: The total yearly cost of insurance premiums for all of your coverage.

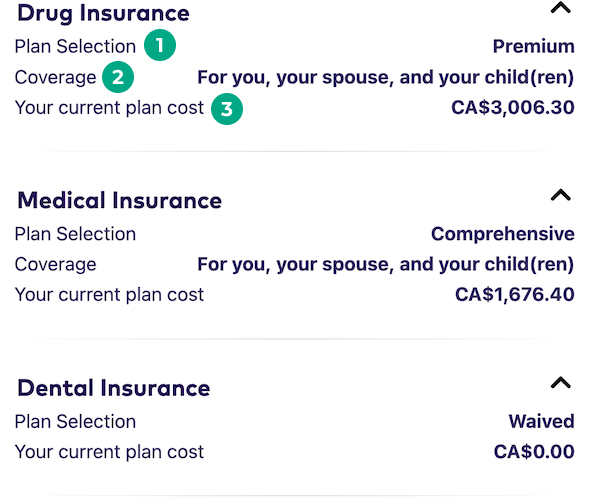

Insurance

Type of coverage: The types of insurance that were available in the last plan year.

Plan selection: The amount of coverage you currently have for each type of insurance. If you didn’t enroll in this benefit, this will say “Waived”.

Your current plan cost: The total yearly cost of insurance premiums for each type of insurance.

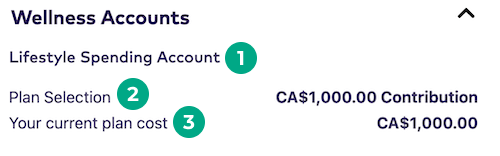

Wellness Account contributions

Wellness Account name: The name of each Wellness account that you allocated money to for the current plan year.

Plan selection: The amount of money you allocated to each Wellness Account.

Your current plan cost: The amount of money you allocated to each Wellness Account.

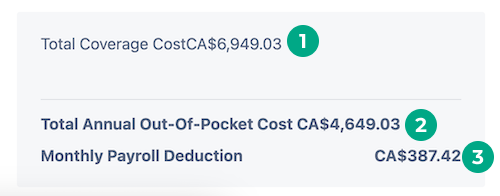

Coverage cost

Total Coverage Cost: The total yearly cost of your current plan selections. This includes insurance premiums and Wellness Account allocations.

Total Annual Out-Of-Pocket Cost: The total yearly cost for all plan selections.

Monthly or Semi Monthly Payroll Deductions: How much money is deducted from each paycheck to cover your out-of-pocket costs.

Note: If you have flexible dollars (money your employer gives you to pay for your benefits), we’ll also display the total amount of flexible dollars used to cover your total coverage cost.

.png)